Dragon Pattern Trading

The dragon pattern is a strong signal that the market is preparing for a trend reversal. When you understand what it looks like and how to trade it, the dragon pattern can help you enter with confidence, not guesswork.

Whether you're new to technical analysis or already spotting breakouts, adding the dragon to your playbook gives you another way to see what buyers and sellers are really doing. Let’s break it down.

What Is the Dragon Pattern in Trading?

The dragon pattern is a type of bullish reversal pattern. It shows up after a downtrend and signals that buyers are stepping back in. The name comes from the shape it forms on a chart—it looks like a crouching Chinese dragon.

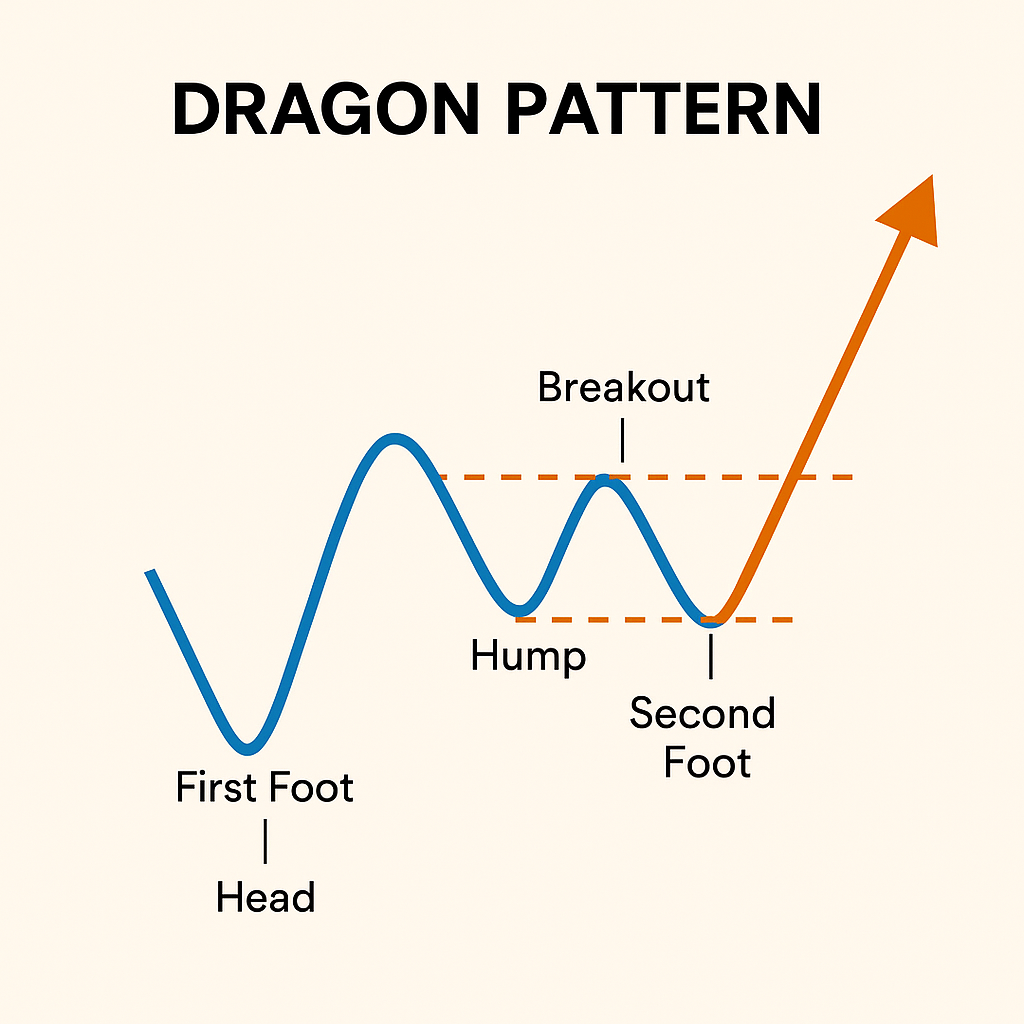

Here’s what it includes:

A sharp drop in price (the head)

A bounce (the first foot)

A pullback that forms a small peak (called the hump)

A second bounce (the second foot, often higher than the first)

When price breaks above the hump, that’s your signal. It’s telling you the trend is turning, and momentum is shifting to the upside.

Some traders confuse the dragon with patterns like double bottoms or inverse head and shoulders. While they share a few features, the dragon pattern has a more rounded structure and includes a visible hump, which sets up a cleaner breakout point.

You’ll often see the dragon form when the market has been trending lower but starts showing signs of slowing. Volume may increase as sellers get exhausted and buyers test the waters. This setup works well across futures markets—especially in contracts with high liquidity like the E-mini S&P or crude oil.

The key is knowing what to look for. In the next section, we’ll map out the dragon’s anatomy so you don’t miss it when it shows up.

Why the Dragon Pattern Works

The dragon pattern works because it reflects a real shift in market behavior. It’s not just lines on a chart. It shows how sellers lose steam, how buyers test the waters, and how momentum builds before the market turns.

Think of it this way:

When the head forms, it’s the last hard push from sellers. They’re trying to keep control.

The first foot is where some traders start buying in, looking for a bounce.

The hump is where price gets rejected. It’s not strong enough to break out yet.

The second foot tells a different story. It’s higher than the first. That means buyers are stepping in earlier. They’re more confident now.

When price breaks above the hump, it’s clear: the mood has changed. Sellers are out of gas, and buyers are ready to move.

This setup often shows up at the end of a long downtrend—when emotions run high and the crowd thinks price will keep falling. That’s when smart traders look for clues that the move is running out.

With the dragon, you’re not just reacting. You’re planning around a repeatable shift in price action. That gives you time to set levels, control risk, and manage your trade with clarity.

Key Elements of the Dragon Pattern

To trade the dragon pattern with confidence, you need to understand each piece. Here’s how to spot the structure on a chart.

The Head

The head is the lowest point in the pattern. It’s a sharp move down in price, often caused by panic selling or bad news. This is where the market hits its low, at least for now.

Traders who chase the move here usually get caught. It feels like momentum will keep going—but the selling pressure is about to slow.

The First Foot

After the head, price bounces. This creates the first foot. It’s a small rally that shows buyers are stepping in. It’s not a strong reversal yet, just a pause in the selling.

You want to pay attention here. This move gives you the first sign that the market might be building support.

The Hump

Next, price pulls back from the bounce and climbs into a small peak. That’s the hump. It’s the key level to watch.

This is where resistance forms. If price can break above this area later, it signals a real breakout and a shift in trend.

The hump is also your breakout trigger. Many traders enter their position once price clears this level with strong momentum.

The Second Foot

This is what sets the dragon apart from other patterns. The second foot dips again but doesn’t drop as low as the first.

It’s higher. That matters.

A higher second foot means the market rejected lower prices. Buyers came in sooner. That’s a clue the trend reversal is gaining strength.

Once the second foot is in, you watch for price to rise and push through the hump. That’s your green light.

The Breakout

The final part is the breakout above the hump. When price moves through that level with momentum, the dragon pattern is complete.

This is where traders often enter long, setting their stop below the second foot and aiming for a measured move or fibonacci target.

How to Trade the Dragon Pattern

Once you recognize the setup, it’s time to trade it. The dragon pattern gives you a simple framework: enter after the breakout, protect yourself with a tight stop, and plan your targets.

Here’s how to trade it step-by-step.

Step 1: Identify the Pattern

Wait for all five parts:

The head (low point)

First foot (small bounce)

Hump (resistance)

Second foot (higher low)

Price climbing back toward the hump

You want the second foot to be in place before entering.

Step 2: Mark the Breakout Point

The hump is your breakout level. Draw a line across the top of that small peak. When the price starts to approach that level again, get ready.

Many traders set a buy stop just above the hump so they’re in the trade only if the pattern completes.

Step 3: Set Your Stop-Loss

Place your stop just below the second foot. This keeps your risk small and avoids getting chopped up if the pattern fails.

If price drops below that second foot, the dragon is invalidated.

Step 4: Plan Your Target

Your first target is usually a 1:1 risk-to-reward ratio. If you risk 10 points, look to make 10.

For a more advanced setup, you can use fibonacci retracement levels from the head to the hump to project your second target. Many traders aim for the 127% or 161.8% extension.

This gives the trade room to run if the breakout gains momentum.

Step 5: Stay Patient

You don’t need to chase the move. Let the pattern form. Wait for the price to confirm the setup before jumping in.

This strategy works best when combined with clear rules, strong price action, and a solid trading plan.

FAQ: Dragon Pattern Trading

Is the dragon pattern the same as a double bottom?

No. The dragon has a distinct hump between the two feet, and the second foot is usually higher than the first. That’s what signals a stronger trend reversal.

What timeframe works best for spotting the dragon pattern?

It can form on any chart, but the 15-minute to 1-hour range is where most traders spot clean dragons in futures markets. For larger moves, use 4-hour or daily charts.

Can I use indicators with the dragon pattern?

Yes, but they aren’t required. Some traders use RSI or MACD to confirm momentum. But the price pattern itself tells the most important story.

What happens if the second foot is lower than the first?

Then it’s not a dragon. The higher second foot is key—it shows buyers are stepping in earlier, which signals strength.

How do I avoid false breakouts?

Wait for strong volume on the breakout above the hump. If the move is slow or weak, stay out. You can also use a close above the hump instead of just a quick touch.