What’s up with the Fed

Preview

As the fourth FOMC meeting of 2024 kicks off, I’m here to provide a comprehensive analysis of its implications for markets and your finances. The Federal Open Market Committee (FOMC) of the Federal Reserve System is convening today and tomorrow to discuss the economy and set future monetary policy.

I will try to give a preview of the meeting, a forecast of Fed policy, and an analysis of its economic impact.

This is no secret

On Wednesday, the Fed is expected to keep its target federal funds rate unchanged at 5.50%, unchanged since July 26, 2023. Moreover, the Fed is unlikely to contradict previous indications that the rate is going to change. The Fed believes it has reached the terminal rate necessary for inflation to decrease without further rate hikes. The lagged effects of prior rate increases are expected to lower inflation to the Fed’s 2.0% target over time.

The June 12 FOMC announcement will include an updated Statement of Economic Projections (SEP), known as the "dots," which are forecasts of interest rates, unemployment, and economic growth from Fed Board members and regional Fed presidents. Historically, these projections have been inaccurate, yet they often receive significant media attention. Fed Chair Jay Powell will hold a press conference after the meeting.

The Fed’s decision to hold rates steady, rather than pivoting to rate cuts as Wall Street has anticipated for two years, stems from its ongoing struggle against inflation.

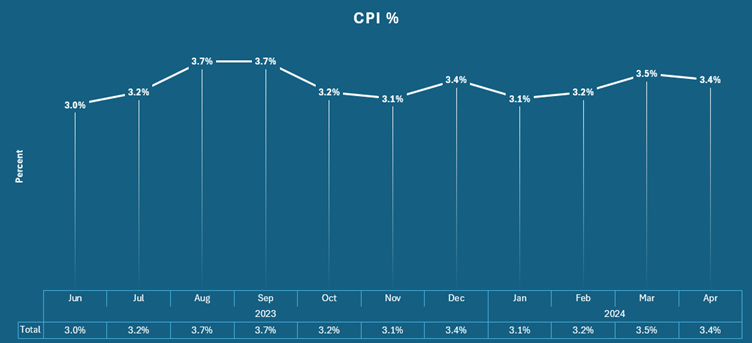

When inflation, measured by the year-over-year Consumer Price Index (CPI), fell from 9.1% in June 2022 to 3.0% in June 2023, the Fed seemed poised to declare victory. Although the goal remained 2.0% annual inflation, the significant drop suggested that 2.0% was within reach. Consequently, the Fed paused rate hikes in July 2023.

However, inflation data since then has been unfavorable for the Fed. This I visualized in the year-over-year CPI Chart below:

The CPI data for May 2024 will be released tomorrow at 8:30 am.

The recent eleven-month data series indicates that inflation is not decreasing. It remains higher today than it was ten months ago, fluctuating within a range around 3.3% and not trending towards the Fed’s 2.0% goal.

The headline CPI for inflation is normally used for analysis because it reflects the actual prices Americans pay, making it the best indicator for understanding behavioural responses, changes in expectations, and political implications. While the Fed and Wall Street use various measures like "core CPI" and "trimmed mean CPI," the headline CPI is most relevant for everyday Americans.

When the Fed claims to be data-dependent, they consider more than just the unemployment rate and CPI. Here’s a summary of recent data, with some supporting a rate cut and some suggesting the Fed should maintain current rates.

Data Supporting a Rate Cut

Unemployment rate increased to 4.0% in the May employment report.

Higher rates for credit cards and mortgages are headwinds to consumption and home purchases.

Consumer savings are depleted, and credit cards are maxed out.

Oil prices declined from $86.90 to $75.85 over the last six weeks.

Gas prices at the pump fell from $3.64/gal to $3.47/gal in the past month.

Most job creation is in part-time jobs.

Labor force participation decreased from 62.7% to 62.5% in the May employment report.

Jobs are predominantly going to illegal aliens.

Data Supporting No Rate Cut

Job creation remains solid, with 272,000 jobs added in the May employment report.

ISM index in services remains strong.

Unemployment rate is still low despite recent increases.

Inflation remains sticky with a central tendency around 3.3% over 11 months.

The Fed prioritizes the inflation rate and given the mixed data and continued inflation above target. Therefore, they will likely refrain from taking any action for now, opting to wait for more data over the next month or two.

The Big Secret!

The press conference tomorrow will provide more insight into the Fed’s future plans. I think it’s clear that the Fed will not cut rates at its June 12th meeting and is unlikely to do so at the July 31 meeting either. Even if inflation decreases next month, the Fed will need two or three months of consistent progress before considering rate cuts.